Retirement Plan Sponsors

Are you confident that you are meeting your fiduciary responsibilities to plan participants?

We can provide a complimentary plan review.

Click here to download "What Matters in a Retirement Plan"

How We Help Our Clients

Managing risk and reducing liability:

- Co-Fiduciary Status

- Full fee disclosure and complete transparency

- We draft and maintain a plan Investment Policy Statement

- Vendor selection and monitoring process

- Ensure that appropriate procedures are in place to fulfill your fiduciary obligations by providing guidance on DOL, IRS and ERISA guidelines.

Delegating more plan tasks:

- Effective vendor management (TPA, Recordkeeper, Custodian…)

- Accurate Reporting & Compliance

- Prudent Investment Selection & Monitoring

- Quarterly statements mailed directly to participants

- Periodic plan review and RFP process management

Creating better participant outcomes:

- Participant education on-site by credentialed professional(s)

- Online educational tools.

- Comprehensive communications program comprised of both printed and online materials

- Daily valuation and online account access with the ability to view and print statements

- Providing safe harbor relief through the offering of a Qualified Default Investment Alternative (QDIA).

Lowering costs, saving more and reducing taxes:

- Customized plan designs may allow an individual to push retirement savings deferrals beyond $59,000 per year (401(k) with Profit Sharing).

- For closely-held businesses we will design and integrate the retirement plan to fit in its proper place within a comprehensive wealth management strategy for the owner(s).

- Fund expenses matter. We use low-cost, evidenced based investment strategies.

Our Strengths

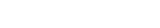

- We are an independent, fee-only and 3(21) fiduciary.

- We take a holistic wealth management approach to all plans large and small.

- Our team collectively, has over 75 years of tax and financial services experience.

Types of Plans We Serve

- IRAs

- SIMPLE (Savings Incentive Match Plan for Employees)

- SEP (Simplified Employee Pension)

- Profit Sharing Plans

- Profit Sharing with 401(k)

- Defined Benefit Plans including Cash Balance

- 403(b)

- Non-Qualified Plans

- ESOP (Employee Stock Ownership Plan)

Download our Plan Sponsor Brochure

For more information on how we serve Retirement Plan Sponsors, please contact us today.